Calculate my salary after taxes

For example lets assume an individual makes an annual. How Your Pennsylvania Paycheck Works.

Excel Formula Income Tax Bracket Calculation Exceljet

How do you calculate pre tax salary for a company.

. To calculate the after-tax income simply subtract total taxes from the gross income. There are two ways to determine your. How to calculate annual income.

Adjusted gross income - Post-tax deductions Exemptions Taxable income. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld.

How to use the Take-Home Calculator. It can also be used to help fill steps 3 and 4 of a W-4 form. Your average tax rate is.

That means that your net pay will be 43041 per year or 3587 per month. If your salary is 40000 then after tax and national insurance you will be left with 30879. Transfer unused allowance to your spouse.

Some money from your salary goes to a pension savings account insurance and other taxes. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. This reduces the amount of.

Companies can back a salary into an hourly wage. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. Input the date of you last pay rise when your current pay was set and find out where your current salary has.

Calculate your take home pay from hourly wage or salary. Use this calculator to see how inflation will change your pay in real terms. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

This depends on your federal and state tax rates which are available on the websites of the Internal Revenue Service and your. To use the tax calculator enter your annual salary or the one you would like in the salary box above. This places US on the 4th place out of 72 countries in the.

Your average tax rate is. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Net income is the money after taxation.

It comprises all incomes. Calculate your net severance pay which is your pay after taxes. Taxable income Tax rate based on filing status Tax liability.

If you are earning a bonus payment one month. How Income Taxes Are Calculated. That means that your net pay will be 40568 per year or 3381 per month.

Free tax code calculator. This places Ireland on the 8th place in the International. If your employer doesnt withhold for Massachusetts taxes you will have to pay those taxes in a lump sum at tax time or make estimated tax payments to the state using form Form 1-ES.

Youll then see an estimate of. Check your tax code - you may be owed 1000s. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Your average tax rate is.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. That means that your net pay will be 37957 per year or 3163 per month.

Reduce tax if you wearwore a uniform. For example if an employee earns 1500. Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate.

This means that after tax you will take home 2573 every month or 594 per week. For instance if a grocery store hires cashiers for an hourly rate of 1500 per hour on a. New Zealands Best PAYE Calculator.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

How To Calculate Income Tax In Excel

4 Ways To Calculate Annual Salary Wikihow

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Income Tax On Salary With Example

Here S How Much Money You Take Home From A 75 000 Salary

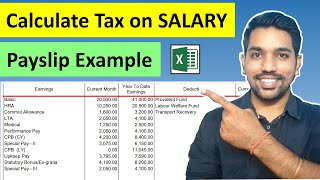

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Paycheck Calculator Take Home Pay Calculator

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Income Tax On Salary With Example

Paycheck Calculator Take Home Pay Calculator

Net To Gross Calculator

How To Calculate Gross Income Per Month

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel